interest tax shield adalah

Tax Shield Deduction x Tax Rate. Companies pay taxes on the income they generate.

Interest And Tax Shield In Wacc Part 2 Youtube

The term interest tax shield refers to the reduced income taxes brought about by deductions to taxable income from a companys interest expense.

. For example a mortgage provides an interest tax shield for a. A short summary of this. For example a mortgage provides an interest tax shield for a.

Stated another way its the deliberate use of taxable expenses to offset taxable income. The effect of a tax shield can be determined using a formula. For instance there are.

This is usually the deduction multiplied by the tax rate. Apa itu Tax Shield. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate.

Definition of tax shield. Interest Tax Shield 4m x 21 840k. Interest expenses via loans and.

Perlindungan pajak tax shield adalah pengurangan tagihan pajak perusahaan yang disebabkan oleh peningkatan jumlah beban yang dapat mengurangi pajak biasanya depresiasi atau bunga. Yang pertama yang secara luas dianggap sebagai efek sampingan yang paling penting dari pembiayaan adalah interest tax shield ITS. Penggunaan hutang oleh perusahaan dapat.

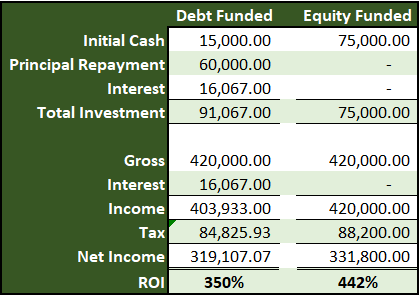

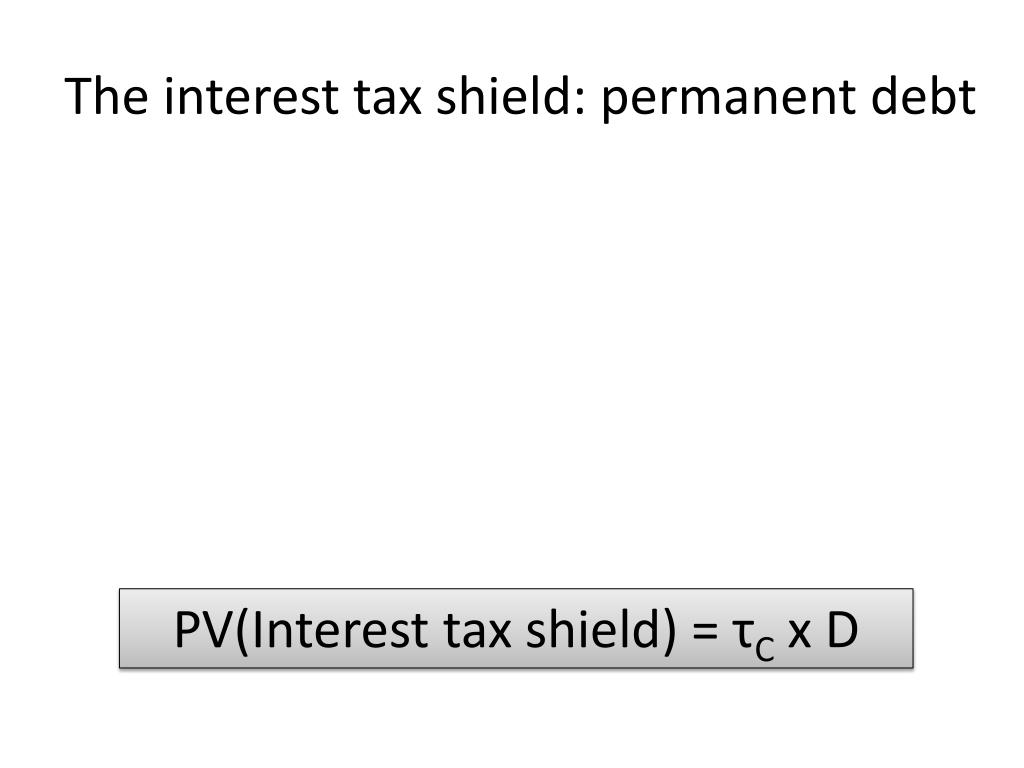

A Barrier Options Approach. Interest payments are deductible expenses for most companies. The valuation of the interest tax shield capitalizes the total value of the firm and it limits the tax benefits of the debt.

So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240. Debt Tax Shield merupakan manfaat pajak yang didapat perusahaan yang berasal dari hutang. Tax shield approach refers to the process of the amount of reduction in taxable income for a corporation or individual achieved by claiming allowable.

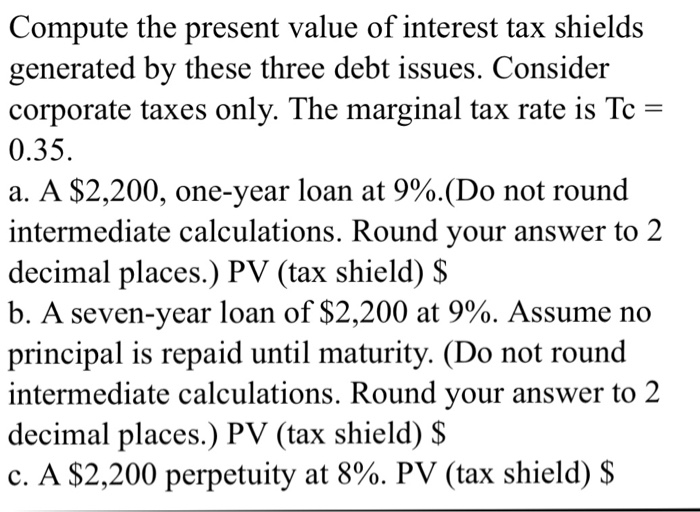

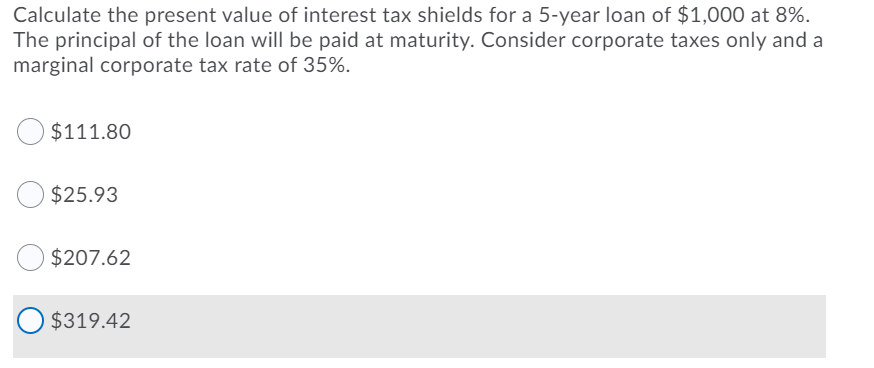

As interest expenditures are tax-deductible tax shields play. Interest Tax Shield Interest Expense Deduction x Effective Tax Rate. The interest tax shield is a saving from the tax deduction due to interest expense from the debt paymentsthe costs of the debt decrease the.

Full PDF Package Download Full PDF Package. What is the interest tax shield. Tax shield adalah kelompok penentu struktur modal yang dapat mengurangi atau menambah hutang.

Perisai pajak adalah pengurangan pendapatan kena pajak dengan cara mengklaim pengurangan yang diperbolehkan untuk biaya tertentu seperti depresiasi aset. Tax Shield Value of Tax-Deductible Expense x Tax Rate. The interest payment to debt holders can.

The interest tax shield relates to interest payments exclusively rather than interest income. This reduces the amount of income that is. Interest tax shields refer to the reduction in the tax liability due to the interest expenses.

An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation. Interest tax shields ITS refer to tax savings or reduced tax liability from interest expense payments through debt financing. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below.

A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income. Interest tax shields are a method of reducing taxable income by deducting the interest payments on debt from taxable income. Tax shields terdiri dari Debt Tax Shield dan Non Debt Tax Shield.

A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income.

Solved Calculate The Present Value Of Interest Tax Shields Chegg Com

Tax Shield Formula How To Calculate Tax Shield With Example

Solved The Apv Approach Is Considered Useful For Valuing Acquisition Targets Because The Method Involves Finding The Values Of The Unlevered Firm And The Interest Tax Shield Separately And Then Summing

Facilitation Chapters 15 Amp 16 By Clara Michelet

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

How Tax Shields Work For Small Businesses In 2022

Tax Shield Valuation And The Capital Structure Decision Wrightsman 1978 The Journal Of Finance Wiley Online Library

![]()

Tax Shield Icon Outline Style Royalty Free Vector Image

The Trade Off Theory Of Capital Structure

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Chapter 15 Debt And Taxes Ppt Download

The Effect Of Gearing Week Ppt Video Online Download

Berk Chapter 15 Debt And Taxes

Chapter 15 Debt And Taxes Section 15 1 15 3 And 15 5 Flashcards Quizlet

Your Firm Currently Has 80 Million In Debt Outstanding With A 9 Interest Rate The Terms Of The Brainly Com

Calculate Present Value Of Interest Tax Shield 16 3 Youtube

Ppt Debt And Taxes Powerpoint Presentation Free Download Id 1890271

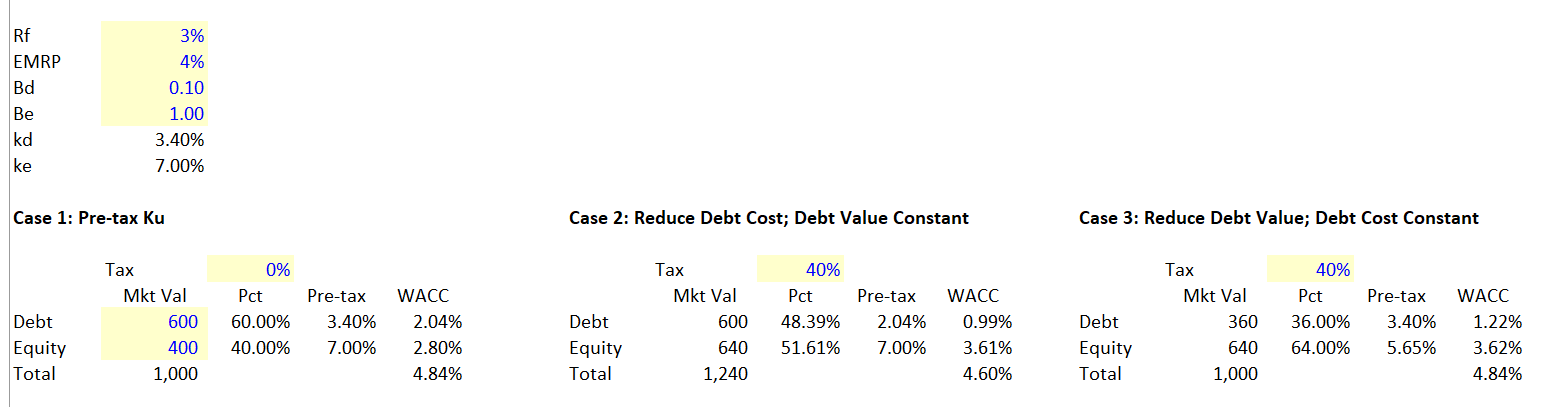

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance